From News Desk

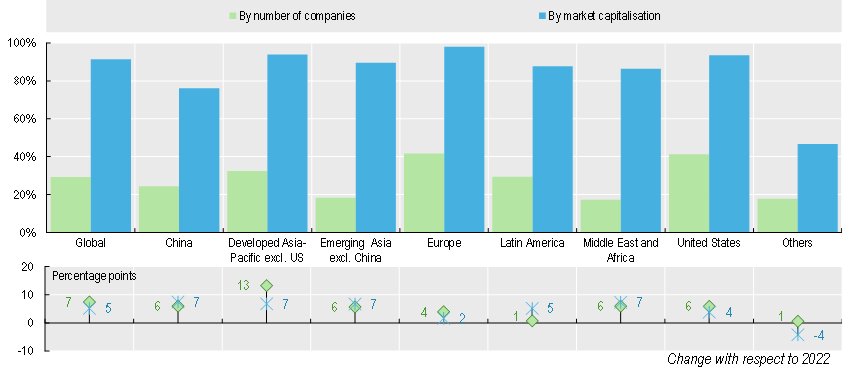

Over the past two years, sustainability-related disclosure has expanded, rising from companies representing 86% of global market capitalisation in 2022 to 91% in 2024. This reflects continued demand for such information from investors. However, the absolute number of companies disclosing sustainability information – 12 900 – remains only a moderate share of the 44 152 listed companies worldwide. Energy companies have the highest rate of disclosure, covering 94% of the industry’s market capitalisation; the real estate sector has the lowest share at 78%.

Disclosure of sustainability-related information by listed companies in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

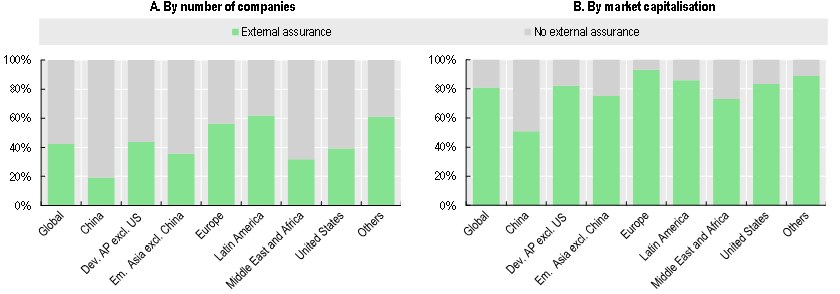

Third-party assurance. Of the 12 900 companies that disclosed sustainability-related information in 2024, 42% obtained assurance of the information by an external service provider. Most companies rely on limited assurance (56%), while far fewer rely on reasonable assurance (17%). The adoption of the International Standard on Sustainability Assurance (ISSA) 5000, finalised in November 2024, is timely. Its adoption by many jurisdictions could strengthen confidence in sustainability reporting and ensure a common understanding of what “limited” and “reasonable” assurance mean across jurisdictions.

Share of companies with assurance of the sustainability-related information in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

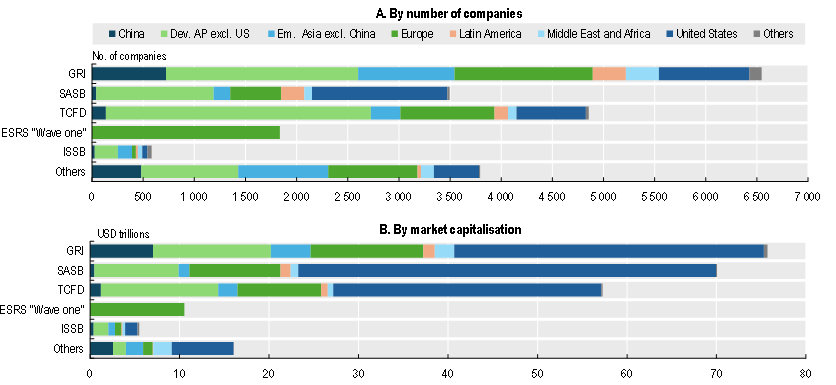

Sustainability-related disclosure standards. Globally, 582 companies use the International Sustainability Standards Board (ISSB) standards, either stating a partial alignment, or asserting compliance, still well below the number of companies using the TCFD recommendations (4 857) or SASB Standards (3 497), which provided the foundations for the ISSB’s standard-setting work. The use of the European Sustainability Reporting Standards (ESRS) remains limited, reflecting their recent adoption in July 2023. Strengthening interoperability among frameworks is critical to reducing compliance costs for companies operating across jurisdictions and to enhancing the comparability, reliability, and decision usefulness of sustainability-related information.

Use of sustainability standards by listed companies in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

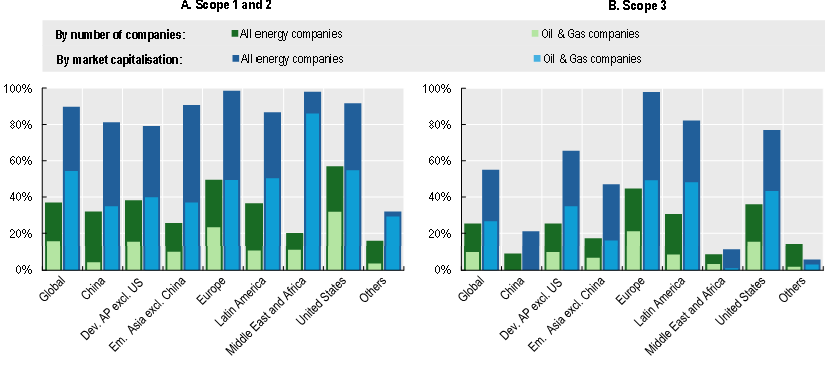

The energy sector’s climate-related disclosure. The energy sector – encompassing the oil, gas, coal and electric power industries – is both a pivotal driver of clean energy deployment and the single largest source of greenhouse gas emissions, accounting for almost a third of total emissions disclosed by listed companies. Disclosure of scope 1 and 2 GHG emissions is relatively high in the energy sector, covering 90% of market capitalisation. However, scope 3 disclosure remains limited, particularly in Emerging Asia and the Middle East and Africa, where fewer than half of companies by market capitalisation report such data.

Listed energy companies – disclosure of scope 1 & 2 and scope 3 emissions in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

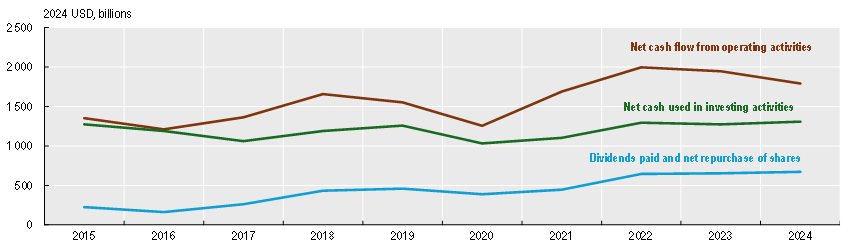

The energy sector’s impact. Tackling GHG emissions will require substantial investment in alternative technologies to replace the combustion of fossil fuels. Between 2015 and 2024, the net cash flow of listed energy companies from operating activities increased by 32%, enabling them to triple dividend payments and share repurchases, while net cash used in investing activities grew by less than 5%. Measures could be implemented to ensure a robust pipeline of bankable energy projects, encouraging firms to allocate a greater share of capital to new investments.

Listed energy companies – disclosure of scope 1 & 2 and scope 3 emissions in 2024

OECD (2025), Global Corporate Sustainability Report 2025, OECD Publishing, Paris, https://doi.org/10.1787/bc25ce1e-en.

The full report was published by the Harvard Law School Forum on Corporate Governance

Disclaimer – The details expressed in this post are from the companies responsible for sending this post for publication. This website doesn’t endorse the details published here. Readers are urged to use their own discretion while making a decision about using this information in any way. There has been no monetary benefit to the Publisher/Editor/Website Owner for publishing this post and the Website Owner takes no responsibility for the impacts of using this information in any way.